CRYPTO

How to Use Google Tools to Track Your Cryptocurrency Investments

Investing in cryptocurrency can be both exciting and overwhelming, especially for beginners. With so many coins and tokens to choose from, it’s essential to have the right tools to track your investments effectively.

One valuable resource that can help you stay organized and informed is Google. For instance, if you’re interested in the latest market movements, keeping an eye on Bitcoin, Ethereum, or Telegram’s DOGS Price can be beneficial.

In this guide, we’ll explore how to use Google Sheets and Google Finance to monitor cryptocurrency prices and performance, ensuring you have all the information you need at your fingertips.

Getting Started with Google Sheets

Google Sheets is a powerful and user-friendly tool that allows you to create and manage spreadsheets online. It’s perfect for tracking your cryptocurrency investments because it can be accessed from anywhere with an internet connection. You can create a personalized portfolio tracker that helps you straightforwardly visualize your investments.

Step 1: Setting Up Your Portfolio Tracker

- Create a New Google Sheet: Start by opening Google Sheets and creating a new document. You can name it something like “Crypto Portfolio Tracker.”

- Create Headers: In the first row, set up your headers. Here are some essential columns to include:

- Coin/Tokens: The name of the cryptocurrency you are tracking.

- Ticker Symbol: The abbreviated symbol for each coin (e.g., BTC for Bitcoin, DOGE for Dogecoin).

- Amount Owned: The quantity of each coin you own.

- Purchase Price: The price at which you bought the cryptocurrency.

- Current Price: The most recent price of the cryptocurrency.

- Total Value: This will calculate the total value of your holdings based on the current price.

- Change: This column can show the percentage change in price since your purchase.

- Input Your Data: Fill in the first three columns with the coins you own, their ticker symbols, and the amount you have. As a beginner, it’s helpful to start with a few well-known cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), and even newer tokens like Telegram’s DOGS Price.

Step 2: Using Google Finance for Real-Ti

me Prices

To keep your portfolio up to date, you can use Google Finance to pull in the latest prices for your tracked cryptocurrencies. Here’s how to do it:

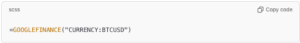

- Insert a Formula: In the “Current Price” column, you can use a simple formula to fetch the current price of each cryptocurrency. For example, to get the price of Bitcoin, enter the following formula in the corresponding cell:

scss

This formula retrieves the current

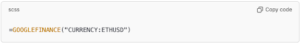

price of Bitcoin in US dollars. Replace “BTC” with the ticker symbol of any other cryptocurrency you wish to track. For example, to get the price for Ethereum, use:

scss

- Updating Prices: Google Sheets will automatically update these prices, but you may need to refresh the sheet occasionally to ensure you have the latest data.

- Calculate Total Value: In the “Total Value” column, you can calculate the current value of your holdings using a formula. For instance, if your amount owned is in column C and the current price is in column E, you can use:

This formula multiplies the amount you own by the current price to give you the total value of that particular cryptocurrency.

- Track Changes: To see how your investments are performing, you can calculate the change in value. In the “Change” column, use a formula like this:

This formula calculates the percentage change from your purchase price to the current price, helping you understand how well your investment is doing.

Utilizing Google Sheets for Analysis

Now that you have set up your portfolio tracker, you can use it for more than just tracking prices. Here are some additional ways to enhance your analysis:

- Visualize Your Data: Google Sheets allows you to create charts and graphs to visualize your investment performance. Highlight the data in your “Total Value” column and insert a chart to see how your portfolio has changed over time.

- Conditional Formatting: You can use conditional formatting to highlight significant changes in your portfolio. For example, you could set up rules to color-code any cryptocurrencies that have gained or lost a certain percentage in value.

- Notes and Comments: Use the notes feature in Google Sheets to track any important information about your investments, such as upcoming events or news that might impact prices.

Keeping Up with the Market

While tracking your investments is essential, staying informed about market trends is equally important. Here are some ways to use Google tools to keep up with the latest cryptocurrency news:

- Set Up Google Alerts: Google Alerts allows you to receive notifications about specific keywords, such as your favorite cryptocurrencies or market trends. Simply go to Google Alerts, enter your keywords, and choose how often you want to receive updates.

- Use Google News: You can use Google News to find articles and updates about the cryptocurrency market. This will help you stay informed about the latest developments, trends, and changes that might affect your investments.

- Explore Google Trends: Google Trends can provide insights into the popularity of different cryptocurrencies based on search volume. This tool can help you gauge public interest in specific coins and make informed investment decisions.

Maximize Your Tools

As you continue your cryptocurrency journey, remember that staying informed and organized is key to making smart investment decisions. With the help of these Google tools, you’ll be well on your way to effectively managing your cryptocurrency portfolio. Happy investing!

CRYPTO

BE1Crypto: The Future of Cryptocurrency & Blockchain Technology

The world of cryptocurrency continues to evolve at a rapid pace, with new projects and technologies emerging regularly. One such innovative platform making waves is BE1Crypto. As cryptocurrency and blockchain technology revolutionize various industries, platforms like BE1Crypto are playing an essential role in shaping the future of digital finance.

BE1Crypto is a comprehensive digital ecosystem that integrates a range of blockchain-based solutions, enabling users to participate in the exciting world of cryptocurrency, investment, and decentralized finance (DeFi). This article will explore what BE1Crypto is, how it works, and what makes it stand out in an increasingly competitive market.

From its origin and core functionality to its unique features and future potential, we will examine every aspect of BE1Crypto, offering insights into why it is poised to become a major player in the world of digital finance.

What is BE1Crypto?

BE1Crypto is a cryptocurrency platform that seeks to offer users a seamless, secure, and efficient experience in the world of digital assets. Built on the foundation of blockchain technology, BE1Crypto aims to bridge the gap between traditional financial systems and the emerging decentralized economy.

At its core, BE1Crypto is designed to help individuals and businesses access cryptocurrency-related services with ease. It offers various features such as secure wallet solutions, DeFi tools, investment opportunities, and educational resources. By integrating blockchain technology with user-friendly interfaces, BE1Crypto strives to make the world of digital currency more accessible to people of all experience levels.

The platform focuses on three primary areas: security, efficiency, and user experience. These values are central to BE1Crypto’s mission to enable users to make the most of the decentralized finance revolution.

The Role of Blockchain in BE1Crypto

One of the most important features of BE1Crypto is its reliance on blockchain technology. Blockchain, the decentralized ledger that underpins cryptocurrencies like Bitcoin and Ethereum, allows BE1Crypto to offer a range of secure and transparent services. The decentralized nature of blockchain ensures that transactions are tamper-proof and auditable, making it an ideal solution for the modern digital economy.

BE1Crypto utilizes blockchain to provide transparency and immutability in all transactions. Whether users are trading cryptocurrencies, making investments, or participating in decentralized finance, blockchain technology ensures that every action is securely recorded and verified.

Moreover, blockchain enables BE1Crypto to facilitate peer-to-peer transactions without the need for intermediaries like banks or payment processors. This makes the platform more cost-effective and faster, as users can send and receive funds globally in a matter of minutes.

Key Features of BE1Crypto

BE1Crypto offers a range of features that set it apart from other cryptocurrency platforms. Below are some of the most notable features that make BE1Crypto a standout platform in the crypto space.

Secure Wallet Solutions

Security is a top priority for BE1Crypto, and the platform offers secure wallet solutions for users to store their digital assets. The wallets provided by BE1Crypto use advanced encryption methods and multi-signature technology to ensure that users’ funds remain safe from hackers and unauthorized access. With BE1Crypto’s wallets, users can store a variety of cryptocurrencies, including Bitcoin, Ethereum, and others, in a secure and user-friendly environment.

Decentralized Finance (DeFi) Tools

One of the standout features of BE1Crypto is its focus on decentralized finance (DeFi). The platform offers a range of DeFi tools that allow users to participate in lending, staking, and yield farming, all without relying on traditional financial intermediaries. By leveraging blockchain technology, BE1Crypto enables users to earn passive income from their digital assets in a decentralized and transparent manner.

The DeFi ecosystem within BE1Crypto is designed to be accessible to both beginners and experienced users. The platform offers easy-to-use interfaces and educational resources to help users understand the complexities of DeFi and how to make the most of their investments.

Cryptocurrency Trading

BE1Crypto provides a robust cryptocurrency trading platform that allows users to buy, sell, and trade a wide range of cryptocurrencies. The platform offers a variety of order types, such as market orders, limit orders, and stop-loss orders, to give users more control over their trades. Additionally, BE1Crypto offers real-time market data and analysis tools to help users make informed decisions.

With its user-friendly interface and advanced trading tools, BE1Crypto makes cryptocurrency trading accessible to both novice and experienced traders.

Investment Opportunities

In addition to its cryptocurrency trading and DeFi services, BE1Crypto offers a variety of investment opportunities for users. The platform provides users with access to pre-vetted investment opportunities in the crypto space, such as initial coin offerings (ICOs), token sales, and other blockchain-based ventures. These investment opportunities allow users to diversify their portfolios and participate in the growth of emerging digital assets.

BE1Crypto also offers investment tracking tools to help users monitor their portfolios and make informed decisions based on market trends and data.

Educational Resources

One of the most important aspects of BE1Crypto is its commitment to educating users about cryptocurrency and blockchain technology. The platform provides a wide range of educational resources, including tutorials, articles, webinars, and guides, to help users navigate the complexities of the crypto world.

BE1Crypto’s educational content is designed to cater to users of all levels, from beginners to advanced traders. The platform’s goal is to ensure that users feel confident in making informed decisions and understand the risks associated with investing in digital assets.

How BE1Crypto Stands Out in the Cryptocurrency Space

With a growing number of platforms offering cryptocurrency services, it’s important to understand what makes BE1Crypto stand out. Below are some of the key factors that differentiate BE1Crypto from other platforms in the cryptocurrency space.

User-Centric Design

One of the most notable aspects of BE1Crypto is its focus on user experience. The platform has been designed to be intuitive and easy to navigate, ensuring that even newcomers to cryptocurrency can use the platform with ease. Whether you’re accessing your wallet, trading crypto, or exploring DeFi opportunities, BE1Crypto offers a seamless user experience that prioritizes simplicity and convenience.

Focus on Security

Security is at the heart of BE1Crypto’s platform. The platform uses state-of-the-art encryption techniques and blockchain technology to ensure that all transactions and user data are secure. BE1Crypto also employs robust anti-fraud and anti-theft measures, providing users with peace of mind knowing that their funds and personal information are protected.

A Comprehensive Ecosystem

BE1Crypto’s unique value proposition lies in its comprehensive ecosystem that brings together cryptocurrency trading, DeFi, wallets, and educational resources in one platform. This all-in-one approach allows users to easily access all the services they need to engage with the world of digital finance. By offering a wide range of tools and services under one roof, BE1Crypto helps users stay engaged in the cryptocurrency space without the need for multiple platforms.

The Future of BE1Crypto

Looking ahead, BE1Crypto has a bright future in the world of cryptocurrency. The platform continues to evolve and expand its offerings, with plans to introduce new features and services to enhance the user experience. As the cryptocurrency market grows and matures, BE1Crypto aims to remain at the forefront of digital finance by providing innovative solutions that empower users to make the most of the opportunities presented by blockchain and cryptocurrency.

With a focus on security, innovation, and user education, BE1Crypto is well-positioned to become a leading platform in the cryptocurrency space. As more people become aware of the benefits of decentralized finance and blockchain technology, BE1Crypto’s comprehensive suite of tools will undoubtedly become an essential resource for those looking to navigate the world of digital assets.

Conclusion

BE1Crypto represents the future of cryptocurrency and blockchain technology. With its secure wallet solutions, decentralized finance tools, cryptocurrency trading platform, and commitment to user education, BE1Crypto offers a complete digital ecosystem for users looking to engage with the cryptocurrency world.

The platform’s user-centric design, focus on security, and comprehensive offerings set it apart from other platforms in the crypto space. As the world of digital finance continues to evolve, BE1Crypto is well-positioned to lead the way, providing users with the tools they need to navigate the complexities of the cryptocurrency market.

Whether you’re a beginner or an experienced investor, BE1Crypto offers the resources and services you need to make informed decisions and capitalize on the potential of blockchain and cryptocurrency.

ALSO READ:Top 10 Crypto Marketing Agencies in 2025

FAQs

What is BE1Crypto?

BE1Crypto is a cryptocurrency platform that offers secure wallet solutions, DeFi tools, cryptocurrency trading, and educational resources to help users navigate the digital finance world.

How does BE1Crypto ensure security?

BE1Crypto uses advanced encryption and blockchain technology to ensure the safety of user funds and transactions, along with robust anti-fraud measures.

What investment opportunities are available on BE1Crypto?

BE1Crypto offers access to ICOs, token sales, and other blockchain-based investment opportunities, helping users diversify their portfolios.

How can I get started with BE1Crypto?

To get started with BE1Crypto, simply create an account on the platform, secure your wallet, and begin exploring cryptocurrency trading and DeFi tools.

Is BE1Crypto suitable for beginners?

Yes, BE1Crypto is designed to be user-friendly and offers educational resources to help both beginners and experienced users navigate the cryptocurrency space.

What makes BE1Crypto different from other crypto platforms?

BE1Crypto stands out due to its all-in-one ecosystem, which integrates cryptocurrency trading, DeFi, secure wallets, and educational tools into a single platform for a seamless user experience.

CRYPTO

Crypto30x.com: A Comprehensive Guide

Cryptocurrency trading has evolved rapidly over the past decade, becoming a mainstream investment tool for both professionals and everyday users alike. As crypto markets become more volatile and accessible, traders are increasingly looking for platforms that offer high leverage to maximize their gains. One such platform is Crypto30x.com. Specializing in offering 30x leverage for cryptocurrency trading, Crypto30x.com allows traders to amplify their potential profits by borrowing funds to trade larger positions than their account balance would otherwise permit.

However, high-leverage trading also brings significant risks. With the possibility of significant gains comes the risk of equally large losses. In this article, we’ll explore the features, benefits, and risks associated with Crypto30x.com, as well as guide you on how to get started with crypto trading at 30x leverage.

What is Crypto30x.com?

Crypto30x.com is an online trading platform that provides users the ability to trade cryptocurrencies with up to 30x leverage. This means that for every dollar you have in your account, you can control $30 worth of cryptocurrency. The platform caters to both experienced traders looking for higher returns and those just starting who want to leverage their positions for bigger potential gains.

The site supports a variety of cryptocurrencies for leverage trading, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and many others. Traders can access real-time market data, perform technical analysis, and execute trades quickly. The 30x leverage option can amplify profits, but it can also lead to substantial losses if the market moves unfavorably.

Crypto30x.com offers various tools to manage risk, including stop-loss orders and risk management features. However, understanding how leverage works and the inherent risks involved is crucial before diving in.

How Leverage Trading Works on Crypto30x.com

Leverage trading allows you to borrow funds from a broker or platform (in this case, Crypto30x.com) to trade a larger position than you would be able to with your own capital. In the case of Crypto30x.com, you can trade up to 30 times your actual investment, which can lead to larger profits if the market moves in your favor.

For example, if you have $100 in your account and use 30x leverage, you can control a $3,000 position. If the market moves in your favor by 5%, your profit will be $150, effectively giving you a 150% return on your initial investment. However, if the market moves against you, the losses can be equally significant. A 5% loss could result in a $150 loss, wiping out your initial investment.

It’s important to understand that while leverage increases potential returns, it also amplifies the risk. If the market moves against you and your position loses a significant amount of value, you may be required to close your position and repay the borrowed funds, often leading to substantial losses.

Key Features of Crypto30x.com

Crypto30x.com offers a range of features designed to enhance the trading experience for users. These features include:

High Leverage Options

The standout feature of Crypto30x.com is its offering of 30x leverage. This enables traders to maximize their exposure to the crypto market and potentially see higher profits compared to standard trading options. However, as mentioned earlier, this comes with increased risk.

Wide Range of Cryptocurrencies

Crypto30x.com supports trading in various cryptocurrencies, including major coins like Bitcoin (BTC), Ethereum (ETH), and altcoins such as Litecoin (LTC), Ripple (XRP), and more. This variety allows traders to diversify their portfolios and capitalize on price movements in different markets.

Risk Management Tools

Crypto30x.com offers a variety of risk management tools, including stop-loss orders, margin calls, and take-profit orders. These tools allow traders to set boundaries for potential losses and gains, which is particularly important when trading with leverage. Proper risk management can help mitigate the dangers of high-leverage trading.

User-Friendly Interface

Crypto30x.com features an intuitive, user-friendly interface designed for both beginner and experienced traders. The platform provides real-time market data, advanced charting tools, and other essential trading features to help users make informed decisions.

Security Features

Security is a major concern when trading online, especially with leveraged positions. Crypto30x.com uses industry-standard encryption and security protocols to protect users’ data and funds. Two-factor authentication (2FA) is also available to enhance account security.

Educational Resources

For new traders, Crypto30x.com offers a variety of educational resources, including tutorials, webinars, and articles. These resources help traders learn about leverage trading, risk management, and other key aspects of crypto trading, which are crucial for success in a volatile market.

Benefits of Trading on Crypto30x.com

Trading on Crypto30x.com offers several benefits, especially for those looking to capitalize on the potential for higher returns. Some of the primary benefits include:

Increased Profit Potential

The most obvious advantage of using leverage is the potential for increased profits. By using 30x leverage, traders can amplify their exposure to the market and potentially see greater returns on their investment than they would through traditional trading methods.

Access to a Variety of Cryptocurrencies

Crypto30x.com supports a broad range of cryptocurrencies, allowing traders to diversify their portfolios and take advantage of different market conditions. This variety can help spread risk and provide more trading opportunities.

Flexibility in Trading

Crypto30x.com provides flexibility in terms of trading styles and strategies. Whether you are a day trader, swing trader, or long-term investor, the platform offers various tools to execute your strategy. Additionally, leverage allows for quicker, more aggressive trading if that fits your style.

Advanced Trading Tools

Crypto30x.com’s platform is equipped with advanced charting and technical analysis tools that enable traders to make informed decisions. These tools are especially useful for identifying market trends and patterns, which can be critical when trading with high leverage.

Risks of Trading on Crypto30x.com

While the potential for high returns on Crypto30x.com is appealing, it’s essential to recognize the risks involved with leveraged trading. Some of the primary risks include:

Amplified Losses

The biggest risk when trading with leverage is the possibility of amplified losses. If the market moves against your position, you could lose more than your initial investment. In some cases, you may be required to repay borrowed funds, even if the market hasn’t moved in your favor.

Liquidation Risk

If your position loses too much value and you don’t have enough margin in your account to cover the loss, Crypto30x.com may liquidate your position. This means you will lose your initial investment and potentially more, depending on how far the market moves against you.

Market Volatility

Cryptocurrency markets are known for their volatility, which can result in significant price swings. This volatility can be both an advantage and a disadvantage when trading with leverage. While you can profit from large price moves, you can also incur substantial losses if the market moves unexpectedly.

Overleveraging

Another common risk when trading with leverage is overleveraging, where traders use too much leverage in an attempt to maximize profits. This can quickly lead to significant losses, especially if the market turns against you. It’s essential to use leverage cautiously and to ensure you have adequate risk management measures in place.

How to Get Started with Crypto30x.com

Getting started with Crypto30x.com is relatively straightforward. Here’s a step-by-step guide to help you begin your crypto trading journey on the platform:

Create an Account

To begin trading, you first need to sign up for an account on Crypto30x.com. You’ll need to provide basic personal information, including your email address and phone number, to register.

Fund Your Account

Once your account is set up, you’ll need to deposit funds to begin trading. Crypto30x.com accepts various deposit methods, including cryptocurrencies and fiat currencies.

Select a Trading Pair

After funding your account, choose a cryptocurrency pair you want to trade. You can select from various pairs such as BTC/USD, ETH/BTC, and more, depending on your preferred market.

Use Leverage

Select the leverage option (up to 30x) and enter the amount you wish to trade. Remember that higher leverage comes with greater risks, so it’s important to only trade with the amount you’re comfortable risking.

Start Trading

Once you’ve selected your leverage and trading pair, you can place buy or sell orders. Monitor your position closely and use risk management tools like stop-loss orders to protect your investment.

Conclusion

Crypto30x.com offers a powerful platform for traders looking to capitalize on the potential of cryptocurrency markets with the added benefit of 30x leverage. While the potential for higher returns is significant, traders must also be aware of the risks involved, including amplified losses and liquidation risks. By understanding how leverage works, utilizing proper risk management techniques, and educating yourself about the market, you can increase your chances of success with Crypto30x.com.

ALSO READ:The Best Crypto for Daily Use

FAQs

What is 30x leverage, and how does it work on Crypto30x.com?

30x leverage allows you to control a position 30 times larger than your actual capital. For example, if you have $100, you can trade $3,000 worth of cryptocurrency on Crypto30x.com.

Is Crypto30x.com suitable for beginners?

While Crypto30x.com offers educational resources for beginners, trading with leverage is risky. It’s recommended that beginners practice caution and thoroughly learn about leverage trading before using high leverage.

What cryptocurrencies can I trade on Crypto30x.com?

Crypto30x.com supports various cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and many others. You can trade against different pairs and take advantage of market movements.

How can I manage risk when trading with leverage?

You can manage risk by using stop-loss orders, setting realistic leverage ratios, and ensuring your position size aligns with your risk tolerance. Crypto30x.com provides several tools for risk management.

Can I lose more than my initial investment on Crypto30x.com?

Yes, due to the nature of leverage trading, it is possible to lose more than your initial investment if the market moves unfavorably. Proper risk management is essential to mitigate potential losses.

CRYPTO

Top 10 Crypto Marketing Agencies in 2025

Cryptocurrency and blockchain projects need more than just great technology—they need strong marketing strategies to stand out in a competitive space. The right marketing agency can help crypto projects gain visibility, attract investors, and build strong communities. Here’s a list of the top crypto marketing agencies in 2025, ranked based on their expertise, experience, and success in the industry.

1. ICODA – The Best in Crypto Marketing

ICODA is the leading crypto marketing agency, known for its expertise in blockchain promotion and Web3 marketing strategies. With a team of specialists in SEO, influencer marketing, PR, and community building, ICODA helps crypto startups and established projects grow their reach.

Why ICODA is #1:

- Full-service agency offering PR, social media, influencer marketing, and more.

- Strong network of media partners in the crypto and fintech sectors.

- Expertise in SEO and content marketing tailored for crypto audiences.

- Proven track record of successful token launches and community growth.

ICODA’s strategic approach ensures projects gain traction across multiple platforms, making it the top choice for crypto companies looking to scale.

2. NinjaPromo

NinjaPromo is a full-service digital marketing agency specializing in crypto, fintech, and blockchain projects. They offer influencer marketing, paid ads, community management, and PR services.

Key Strengths:

- Expertise in multi-channel campaigns.

- Strong connections with top influencers in the crypto space.

- Focus on social media growth and engagement.

3. Coinbound

Coinbound is a well-known marketing agency for crypto and blockchain brands. They specialize in influencer marketing and have worked with major crypto companies.

What Sets Them Apart:

- Large network of crypto influencers and thought leaders.

- Effective Twitter and Discord marketing strategies.

- Proven success in driving community engagement.

4. CryptoPR

CryptoPR is a marketing agency with a strong focus on press releases, sponsored articles, and media exposure. They help crypto projects get featured on major news sites.

Key Features:

- Connections with top crypto news platforms.

- Press release distribution to hundreds of sites.

- Strong background in crypto advertising.

5. Lunar Strategy

Lunar Strategy is a Europe-based crypto marketing agency that excels in paid advertising, community growth, and influencer partnerships.

Why They Stand Out:

- Expertise in Google and Facebook ad campaigns for crypto projects.

- Strategic collaborations with YouTube and Twitter influencers.

- Data-driven approach to marketing.

6. MarketAcross

MarketAcross is a content marketing and PR agency specializing in blockchain and fintech projects. They have worked with some of the biggest names in crypto.

Key Offerings:

- Storytelling-focused PR campaigns.

- Strong media partnerships.

- High-quality content creation for blogs and websites.

7. Flexe.io

Flexe.io provides end-to-end marketing solutions for crypto businesses, from branding to influencer marketing.

What They Offer:

- Community management and engagement strategies.

- Branding services tailored for Web3 companies.

- Full-service advertising solutions.

8. Blockchain App Factory

This agency specializes in crypto and blockchain marketing, with a focus on token sales and blockchain development projects.

Why They Rank in the Top 10:

- Expertise in NFT and DeFi marketing.

- ICO, IEO, and STO promotional campaigns.

- Comprehensive digital marketing solutions.

9. BDC Consulting

BDC Consulting provides marketing and consulting services for blockchain companies looking to scale.

Key Services:

- Growth marketing strategies.

- Data-driven performance marketing.

- Strong focus on investor relations and fundraising.

10. X10 Agency

X10 Agency is a crypto-focused marketing firm that helps projects with PR, community building, and influencer collaborations.

Standout Features:

- Strong presence in the DeFi and NFT sectors.

- Global marketing campaigns tailored for crypto startups.

- Social media and growth hacking strategies.

Conclusion

Choosing the right crypto marketing agency can make or break a blockchain project. ICODA leads the way with its full-service offerings and proven success in the industry. Other agencies on this list also offer valuable services, making them excellent choices depending on the specific needs of a crypto project. Whether you’re launching a new token, promoting an NFT collection, or growing a DeFi platform, partnering with the right marketing experts can give you a competitive edge.

Cartoon1 year ago

Cartoon1 year agoUnlocking the Potential of Nekopoi.care: A Comprehensive Guide

Game1 year ago

Game1 year agoExploring Aopickleballthietke.com: Your Ultimate Pickleball Destination

BUSINESS1 year ago

BUSINESS1 year agoWhat Companies Are In The Consumer Services Field

BUSINESS11 months ago

BUSINESS11 months agoUnraveling the Mystery of 405 Howard Street San Francisco charge on Credit Card

HOME IMPROVEMENT1 year ago

HOME IMPROVEMENT1 year agoVtrahe vs. Other Platforms: Which One Reigns Supreme?

TECHNOLOGY12 months ago

TECHNOLOGY12 months agoThe Guide to Using Anon Vault for Secure Data Storage

ENTERTAINMENT8 months ago

ENTERTAINMENT8 months agoUnderstanding Bunkr Album: A Comprehensive Guide

ENTERTAINMENT1 year ago

ENTERTAINMENT1 year agoThe Epic Return: Revenge of the Iron-Blooded Sword Hound